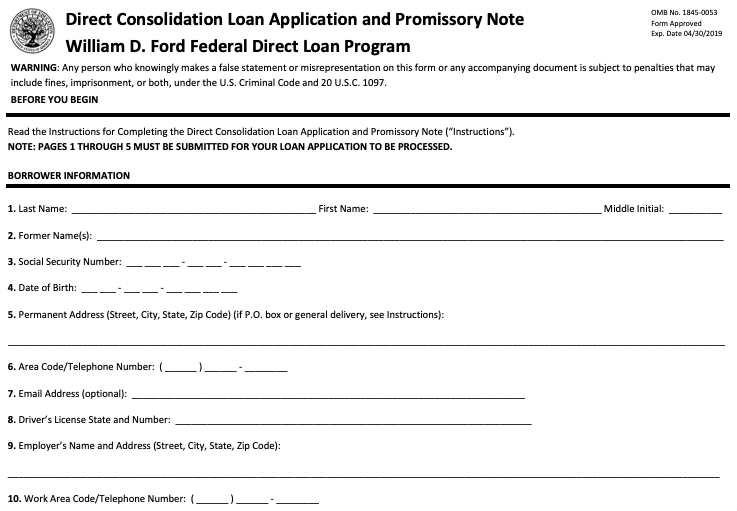

Debemos llenar este formulario cuando solicitemos el préstamo.The significance of this statement cannot be overstated. When applying for a loan, completing the loan application form accurately and on time is paramount. This comprehensive guide will delve into the importance of this form, the key information it typically requests, and best practices for completing it effectively.

The loan application form serves as a crucial foundation for the loan evaluation process. It provides lenders with essential information to assess your financial situation, creditworthiness, and ability to repay the loan. Failure to complete the form accurately or on time can significantly impact your chances of loan approval and may result in delays or even denial.

Significance of Completing the Loan Application Form: Debemos Llenar Este Formulario Cuando Solicitemos El Préstamo.

Completing the loan application form is a crucial step in the loan application process. It serves as a comprehensive document that provides lenders with the necessary information to evaluate an applicant’s creditworthiness and eligibility for a loan.

This form plays a pivotal role in determining whether a loan will be approved, the loan amount, and the interest rate charged. Therefore, it is essential for applicants to complete the form accurately and on time to maximize their chances of loan approval and securing favorable loan terms.

Key Information Typically Requested, Debemos llenar este formulario cuando solicitemos el préstamo.

The loan application form typically requests a range of information, including:

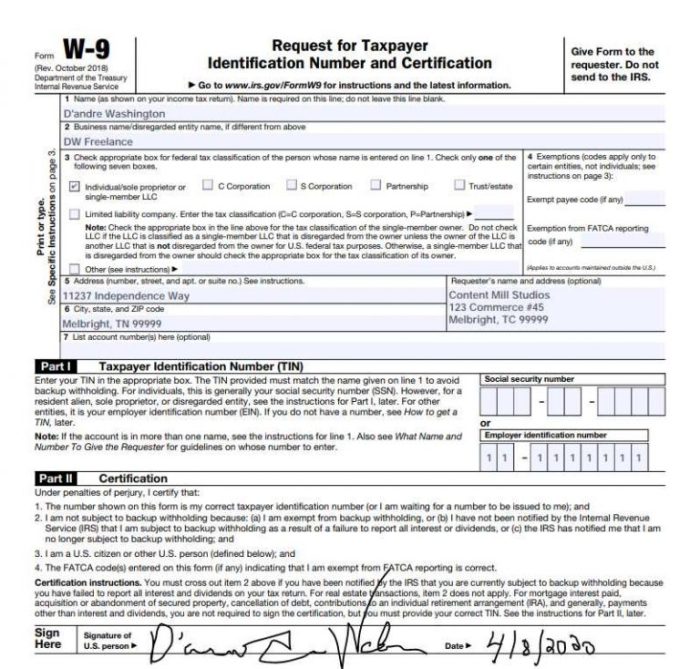

- Personal information (name, address, contact details)

- Financial information (income, assets, debts)

- Employment history

- Loan purpose and amount

- Collateral or security (if applicable)

This information is essential for lenders to assess an applicant’s ability to repay the loan, the risk associated with the loan, and the appropriate loan terms to offer.

Consequences of Incomplete or Inaccurate Form

Failure to complete the loan application form accurately or on time can have several negative consequences:

- Loan application delays or rejection

- Higher interest rates and unfavorable loan terms

- Damage to credit score

Therefore, it is crucial for applicants to take the time to gather the necessary information and complete the form thoroughly and accurately.

Answers to Common Questions

What information is typically requested on a loan application form?

Loan application forms typically request personal information (name, address, contact details), financial information (income, assets, debts), and employment information (employer, job title, salary).

Why is it important to complete the loan application form accurately?

Accuracy is crucial because lenders rely on the information you provide to make a decision about your loan application. Inaccurate information can lead to delays, denials, or unfavorable loan terms.

What are the consequences of not completing the loan application form on time?

Late submissions may result in delays in processing your application or even denial if the lender has a deadline for receiving applications.